Halal Food Opportunities

August 25, 2009

By Ehsan Sairally

The baking industry, like most food industries, is and should always be

open to new market opportunities. However, new ventures can involve a

lot of start-up research effort and expense.

|

|

| The halal market is growing beyond niche status and is poised to enter the mainstream.

|

The baking industry, like most food industries, is and should always be open to new market opportunities. However, new ventures can involve a lot of start-up research effort and expense.

An understandable concern is that the market has been properly identified. In these challenging economic times, it is important to go into markets that are recession-resilient.

Thanks to Canada’s growing diversity, there are consumer food preferences, beliefs and lifestyles that present opportunities for the baking industry.

Today’s food shoppers are involved consumers. They are not only interested in what they eat; they also want to know what’s in the food and how it’s made. New market ventures require a lot of investigative analysis to identify consumers and their preferences.

Industry may not appreciate the fact that in Canada some large untapped markets come with a lot of ready-made, up-front consumer information. The estimated $1 billion Canadian halal market is a case in point. This market is slowly growing beyond niche status and, on some fronts, is poised to become mainstream. Bakery companies contemplating the halal market may be surprised to learn that there is more consumer data available than they think.

Market size and scope

Canada collects religious affiliation information as part of the census process. Hence, there is good official data available on the Muslim population in Canada.

Industries wanting halal consumer information do not have to look too hard. They can get assistance from a food-science-based certification agency such as Halal Product Development Services (HPDS).

A wide variety of demographic information can be derived from census data, such as population numbers and projections, geography (province, city, postal code), ethnicity, origin, immigration and generation status, age, education, income, language usage, etc. The following are some figures on Canadian halal market size by province:

Muslim Population of Canada 2006*

| Province | Pop | % | ||||

| Canada (total) | 842,200 | 100 | ||||

| Newfoundland | 800 | 0.1 | ||||

| Prince Edward Island | 400 | 0.04 | ||||

| Nova Scotia | 5,600 | 0.7 | ||||

| New Brunswick | 1,700 | 0.2 | ||||

| Quebec | 150,400 | 17.9 | ||||

| Ontario | 528,200 | 62.7 | ||||

| Manitoba | 7,000 | 0.8 | ||||

| Saskatchewan | 2,900 | 0.3 | ||||

| Alberta | 65,100 | 7.7 | ||||

| British Columbia | 79,700 | 9.5 | ||||

| Territories | 400 | 0.04 |

*Derived from Stats Can

- Canada’s Muslim population (halal consumers) will soon be approaching 1 million

- Over 80 per cent live in Ontario and Quebec (63 per cent in Ontario and 18 per cent in Quebec)

- Major concentrations are in metropolitan areas, e.g., Toronto, Montreal, Vancouver, Ottawa, Calgary, Edmonton

- The Toronto area will soon have approximately 10 per cent halal consumers

Conceptualizing halal products

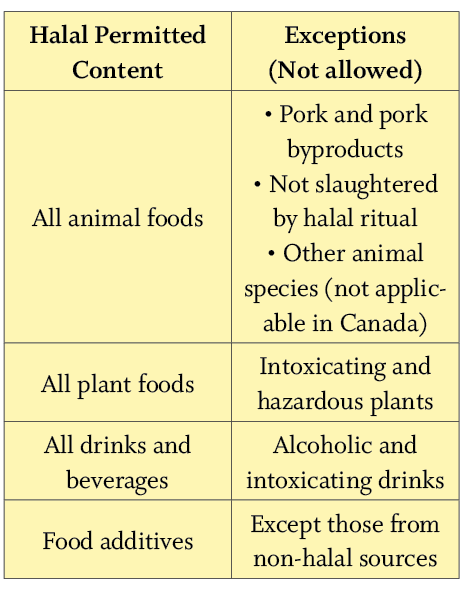

Some people think halal applies to meat products only. In fact, it applies to all food types whether of plant or animal origin.

Understanding halal is essentially appreciating halal consumers’ food needs and buying requirements. Canadian halal consumers come from various ethnic backgrounds, but they have common faith-based dietary needs. Those needs are based on content and process.

The word halal is of Arabic origin and refers to foods and ingredients that are permitted according to the Islamic faith. Various food sources are permitted and not permitted. The major exclusions are pork and pork-derived products.

As far as foods of plant origin are concerned, most are permitted except intoxicating and hazardous plants. Also not permitted are alcoholic drinks and intoxicating substances.

For those animal species that are permitted (e.g., beef, chicken, mutton), there is a prescribed slaughtering protocol. The same requirements apply to food additives. Some additives may have pork derivatives or may be derived from permitted animal species that were not slaughtered according to halal protocol.

The bottom line is that many foods (particularly non-meat categories) and ingredients in the Canadian marketplace are inherently halal, but are not certified. Many bakery products are halal, and those that are not may need only an ingredient substitution. The substitution simply involves using a plant-derived version of the same ingredient or additive.

|

Mainstream halal bakery products

The mainstream baking industry can get into the halal market with minimal investment and minimal adjustment. New products don’t necessarily have to be developed. Many current bakery products are probably halal-compliant and just need certification to reassure the consumer.

To get an idea about faith-based product opportunities, one has only to look at all the kosher bakery products on the market. Baking companies wanting to “go halal” may already be making halal compliant (but not certified) product or may need only a minor ingredient or additive substitution (not a change) in the formulation.

Industrial implications for the baking industry

A certification agency has experience with the baking sector and can help a company make an existing product halal-compliant or develop a new halal product.

The baking industry should have little difficult fitting halal products into their operations. Companies may already have a halal production mindset without realizing it, as producing a halal product is essentially the same as producing an allergen-free product and keeping it that way.

Once a halal product has been formulated and processed, various checkpoint controls are required to ensure there is no co-mingling with non-halal products. The following points should help allay concerns some companies may have as they contemplate the halal bakery goods market:

First, a dedicated plant or line is not required to produce a halal bakery product. With proper checkpoints, GMPs and HACCP-type protocols in place, halal processing can be done in an existing plant where other product types are processed.

Second, industrial halal food processing fits into the Canadian food regulatory framework. There is nothing different about halal bakery products or how they are processed other than the exclusion of certain ingredients as well as co-mingling control.

Third, a halal-certified bakery product can be the same product that the company is already producing for the general market, but with the added benefit of reaching the lucrative halal market as well.

Certification and consumer confidence

Most Canadian halal consumers prefer one-stop shopping and essentially are looking for a halal version of mainstream food products currently available in Canadian supermarkets … and this applies to bakery products as well. Halal consumers are involved food purchasers and need assurance that the foods they buy will fulfil their faith-based dietary requirements. Certification labelling gives that assurance and provides industry with access to a growing halal market – a market that is durable and has been around for 1400 years.

On the web: Halal Product Development Services:

www.halalproductservices.com

Print this page

Leave a Reply