On the rise

May 2, 2011

By Stephanie Ortenzi

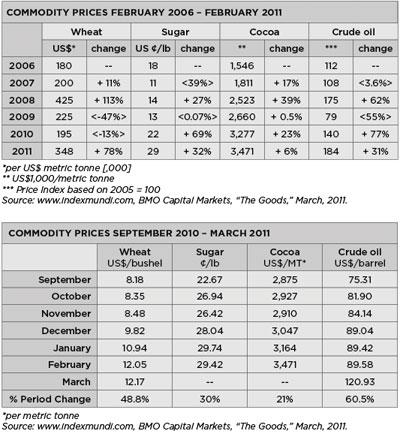

In mid-September, world commodity prices began climbing to levels approaching those seen during the economic meltdown of 2008. That February, crude oil was up 62 per cent from the previous year, wheat was up 113 per cent, and sugar was up 27 per cent. Only cocoa offered the baking sector a relative reprieve, climbing three per cent over 2007 levels.

In mid-September, world commodity prices began climbing to levels approaching those seen during the economic meltdown of 2008. That February, crude oil was up 62 per cent from the previous year, wheat was up 113 per cent, and sugar was up 27 per cent. Only cocoa offered the baking sector a relative reprieve, climbing three per cent over 2007 levels.

Fast forward to the present. Since September 2010, wheat is up 48 per cent, sugar is up 30 per cent and cocoa is up 21 per cent. Fuelling all of these increases is the mid-March hike in the price of crude oil. At press time, crude oil was selling at US$120.93 per barrel, up 61 per cent from the price just seven months ago.

Meanwhile, the political stage is roiling with an as-yet unsuccessful popular revolution in Libya, and triple disasters heartlessly pounding Japan: an earthquake, a tsunami and a potential nuclear accident. It’s little wonder the consumer confidence index is down.

How is the food industry responding?

Galen Weston shared his strategy with the Globe and Mail on March 3. The chairman and president of George Weston said that commodity prices in January alone had cost the company $20 million. To cushion the blow, he continued, George Weston planned to raise the price of bread, cookies and cakes by an average of five per cent, beginning April 1. Other national grocers are following suit; Metro and Sobeys both announced they will raise their prices too. John Scott, CEO of the Canadian Federation of Independent Grocers, recently told the Canadian Press that instead of passing the full price on to the consumer, there would be a reduction in promotions like coupons, which he said had been in abundance in 2010, but will become increasingly rare this year. The same report said Maple Leaf Foods planned to raise fresh bakery prices 20 cents per unit at the end of March.

On the independent front, Shaun Navazesh has some ideas about managing price hikes. Navazesh is the owner of Toronto-based ShaSha Bakery and founder of the Artisan Baker’s Quality Alliance, which buys in bulk, as a collective.

“I’d watched wheat go up and spelt come down. Then sugar went up and vanilla went down,” Navazesh recalls. He felt forced to raise some of his prices, but hasn’t yet introduced higher prices across the board.

Navazesh carefully watches prices in terms of geographic sources and the time of the year. He says he’s created a model, which renders data that tells him when to buy and when to contract.

“Still,” he confesses, “it’s a gamble. Sometimes you lose, and sometimes you win.”

“Right now, we’re going to absorb some of the costs for the short term, watching the timing, particularly at harvest, when farmers are holding back their stock to establish their price.”

Navazesh buys 75 per cent of his ingredients locally. For example, this year, he bought 700 metric tonnes of grain directly from Ontario farmers. The remainder of his ingredients, including sugar, oil and spices, come from outside the country. In the case of his organic palm oil, he buys directly from Brazil. “No middle man,” boasts Navazesh, explaining that the manufacturer shipped the oil to him directly.

His advice to his peers is to go to the source as much as possible. Deal directly with co-operatives, elevators, associations and alliances. “Look for a buying group and buy container loads,“ he advises. “Join together to get the best price on volume. Now, in particular, is the time to do this.”

Stephanie Ortenzi (www.pistachiowriting.com is a Toronto-based food marketing writer.

|

Print this page

Leave a Reply