New government loans and support for small businesses

March 27, 2020

By

Bakers Journal

Emergency Business Accounts and Small and Medium-Sized Business loans are among some forms of financial aid for businesses hit by COVID-19.

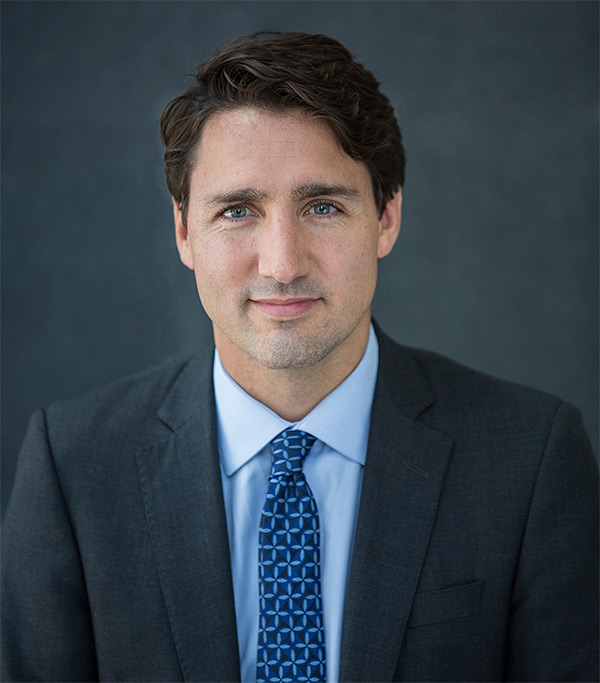

Prime Minister Justin Trudeau announced new measures to support small businesses hit by COVID-19.

Prime Minister Justin Trudeau announced new measures to support small businesses hit by COVID-19. Prime Minister Justin Trudeau announced additional new measures to support small businesses dealing with the economic fallout of the COVID-19 pandemic. These measures are aimed to help Canadian businesses protect their jobs, pay their workers and bills during these difficult times.

Prime Minister Trudeau recognized the importance of bakeries and restaurants: “Small businesses are the backbone of our economy, and an important source of good jobs across this country. They are facing economic hardship and uncertainty during the COVID-19 pandemic, and that is why we are taking action now to help them get the financial help they need to protect their workers and pay their bills.”

The March 27 announcement is a part of the government’s COVID-19 Economic Response Plan, which already commit $107 billion in support to Canadians.

To further support small businesses, the Government of Canada will take on the following measures:

- A 75 per cent wage subsidy for qualifying businesses, for up to 3 months, retroactive to March 15, 2020. This will help businesses to keep and return workers to the payroll. More details on eligibility criteria will start with the impact of COVID-19 on sales, and will be shared before the end of the month.

- Allow businesses, including self-employed individuals, to defer all Goods and Services Tax/Harmonized Sales Tax (GST/HST) payments until June, as well as customs duties owed for imports. This measure is the equivalent of providing up to $30 billion in interest-free loans to Canadian businesses. It will help businesses so they can continue to pay their employees and their bills, and help ease cash-flow challenges across the country.

- Launch the new Canada Emergency Business Account. This program will provide up to $25 billion to eligible financial institutions so they can provide interest-free loans to small businesses. These loans – guaranteed and funded by the Government of Canada – will ensure that small businesses have access to the capital they need, at a zero per cent interest rate, so they can pay for rent and other important costs over the next number of months.

- Launch the new Small and Medium-sized Enterprise Loan and Guarantee program that will enable up to $40 billion in lending, supported through Export Development Canada and Business Development Bank, for guaranteed loans when small businesses go to their financial institutions to help weather the impacts of COVID-19. This is intended for small and medium-sized companies that require greater help to meet their operational cash flow requirements.

These new investments will help Canada’s financial institutions provide the credit and liquidity options that a range of Canadian businesses need immediately.

A statement from the Government of Canada mentioned how the government “understands that some sectors have been disproportionally impacted by the COVID-19 pandemic. We will continue to carefully monitor all developments, and take further action in the near term. We’re all in this together, and the Government of Canada will continue to work around the clock to ensure all Canadians and small businesses get the support they need to weather this crisis.”

Minister of Finance, Bill Morneau added, “The measures that we are taking to protect Canadians and our economy from the impacts of the COVID-19 pandemic remind us that extraordinary times demand extraordinary actions. With the new measures we are announcing today to support businesses, we are showing once again that we will do what we must to ensure that workers and businesses are supported through the outbreak, and that our economy remains strong in the face of adversity.”

Print this page

Leave a Reply